Maintaining an accurate and comprehensive record of organisational assets is crucial for effective asset management. An asset register serves as a central repository of asset information, providing valuable insights for decision-making processes.

Definition of asset register

An asset register can be defined as a database or system that tracks and manages an organisation’s assets throughout their lifecycle. Its primary purpose is to maintain a record of assets, enabling effective monitoring, valuation, and financial reporting.

How to create an asset register

To create an asset register, several key steps need to be followed:

- Identify assets to be included: Begin by determining which assets should be included in the register. This can range from tangible assets such as machinery, equipment, and vehicles to intangible assets like software licenses and patents.

- Determine data fields and information to capture: Define the necessary data fields that will be recorded for each asset. This typically includes asset identification details, purchase information, location and custodian information, maintenance and service history, and depreciation and valuation details.

- Gather asset information and populate the register: Collect the required information for each asset. This may involve conducting physical inspections, consulting purchase records, and liaising with relevant departments.

- Establish a naming and categorisation system: Implement a consistent naming and categorisation system to ensure assets are easily identifiable and organised within the register. This helps streamline asset management processes and facilitates reporting.

- Define ownership and responsible parties: Clearly identify the ownership of assets and assign responsible parties who will be accountable for their maintenance, tracking, and updates within the asset register.

Key components of an asset register

A well-structured asset register should include the following key components:

Asset identification details

This includes the asset’s name, serial number, description, and any unique identifiers necessary for accurate identification.

Purchase information

Record the asset’s purchase date, cost, and supplier information. This data is crucial for financial reporting, warranty tracking, and budgeting purposes.

Location and custodian information

Capture the asset’s physical location within the organisation and the person or department responsible for its custody. This ensures efficient tracking and facilitates maintenance and servicing.

Maintenance and service history

Maintain a log of all maintenance activities and services performed on the asset. This information helps schedule preventive maintenance, identify recurring issues, and evaluate the asset’s overall condition.

Depreciation and valuation details

Track the asset’s depreciation and valuation over time. This information assists in financial reporting, calculating asset values for insurance purposes, and determining asset replacement or disposal.

Maintaining and updating the asset register

To ensure the accuracy and integrity of the asset register, it is essential to implement regular maintenance and update processes:

- Regular audits and physical verification of assets: Conduct periodic audits to physically verify the existence and condition of assets. This helps identify discrepancies between the register and the actual assets.

- Recording additions, disposals, and transfers: Document any additions, disposals, or transfers of assets within the register. This ensures that the register remains up-to-date and reflects the current asset landscape.

- Implementing a change management process for updates: Establish a formal change management process to handle updates to the asset register. This ensures that modifications are properly authorised, documented, and communicated.

- Ensuring data accuracy and integrity: Regularly review and validate the data recorded in the asset register. Address any discrepancies or errors promptly to maintain the register’s reliability.

Using an asset management software for the asset register

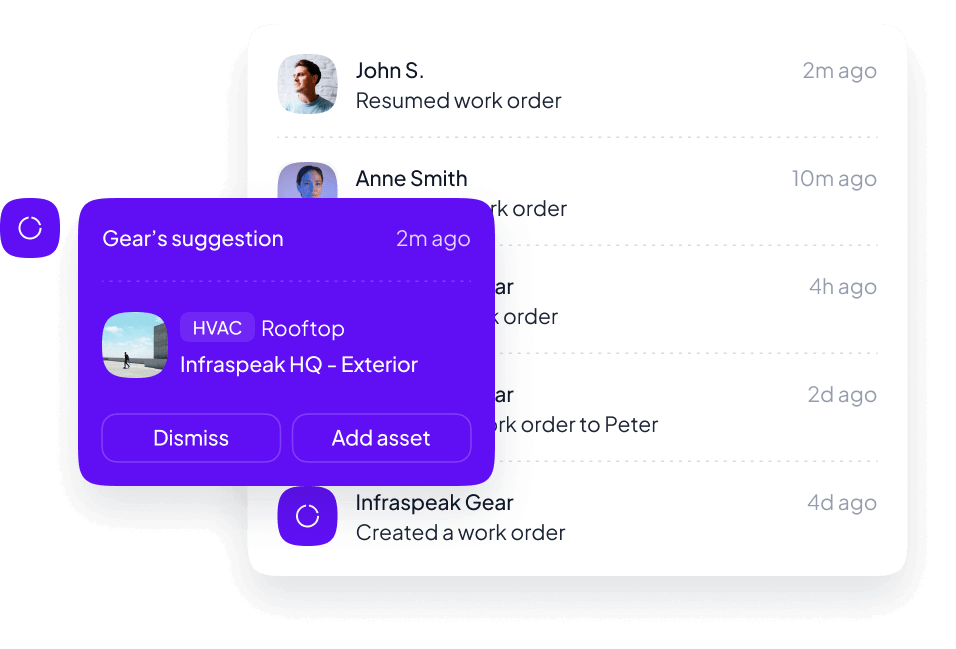

Implementing dedicated asset management software can greatly streamline asset management processes. Look for solutions that offers the following features and functionalities:

- Centralised database: Provides a secure and easily accessible repository for storing and managing asset information.

- Asset tracking and reporting: Enables real-time tracking of assets, generates reports, and offers customisable dashboards for data-driven insights.

- Maintenance scheduling: Allows scheduling and tracking of maintenance activities, ensuring assets are properly serviced and downtime is minimised.

- Integration with other systems: Look for software that seamlessly integrates with other organisational systems such as finance, procurement, and maintenance for efficient data flow and process automation.

- Improved efficiency in facility management.

- Better visibility into asset and team performance.

- More informed and data-driven decision making.

Types of asset registers

Fixed asset register

This type of register is used to document and track fixed assets owned by an organisation. Fixed assets typically include buildings, land, vehicles, machinery, equipment, and other long-term assets.

IT asset register

IT asset registers focus specifically on managing an organisation’s information technology assets. This includes hardware devices (computers, servers, printers), software licenses, network equipment, and other IT-related assets.

Inventory asset register

An inventory asset register is used to track inventory items held by an organisation. It includes details such as stock quantities, purchase dates, reorder levels, and other relevant information.

Financial asset register

This register is used to manage financial assets such as stocks, bonds, mutual funds, and other investment instruments. It helps track the value, acquisition dates, and other financial details related to these assets.

Consumable asset register

This type of register is used to manage consumable assets that are regularly used and depleted within an organisation. It includes items such as office supplies, cleaning materials, and other regularly replenished assets.

Intangible asset register

Intangible asset registers are used to record and manage intangible assets, such as patents, copyrights, trademarks, licenses, and intellectual property. It helps track ownership, expiration dates, and other pertinent information.

Security and data privacy considerations in asset registering

When implementing an asset register, it is crucial to address security and data privacy considerations:

- Implement access controls and user permissions: Restrict access to the asset register based on user roles and responsibilities. This ensures that only authorised individuals can view and modify asset data.

- Back up and secure the asset register data: Regularly back up the asset register data and ensure it is securely stored to prevent loss or unauthorised access.

- Comply with data protection regulations: Adhere to relevant data protection regulations and guidelines to protect sensitive asset information and maintain data privacy.